Key Points:

- Overall, this decade has been continuing to show an inverse correlation between bonds and commodities with falling commodity prices resulting in higher bond prices (falling yields). When inflation is under control and interest rates are subject to an overall downward path, bonds rise as the appeal of safety and income lure investors to purchase them.

- The dollar hit the bottom and started rising during 2011, continuing to rally throughout this decade having a negative impact on commodity prices. During times of crisis like the ones we are living in, money normally flows from risk-on assets such as stocks and commodities to risk-off assets such as the U.S. Dollar and Treasury Bonds.

- Movements in the dollar often play an important role in commodity prices. If commodity markets influence bonds, which then influence stocks, commodities are indirectly linked to stocks. Therefore, if you want to succeed, you should analyze the bond market as well as the commodity sector.

- Trading idea: scroll down to the second half of the article.

Intermarket work suggests that there is an inverse relationship between bonds and commodities. They normally trend in opposite directions. Rising commodity prices cause, generally, bond prices to fall whereas falling commodity prices result in higher bond prices.

As you well know, bond prices and yields are always inversely correlated. When Treasury bond yields are rising (during a period of rising inflation), bond prices will fall and when yields are falling (during a noninflationary period), bond prices are rising. That said, bond yields and commodities prices follow the same direction.

The most widely recognized indicator of today´s global commodity markets is called the Thomson Reuters/Core Commodity CRB Index (CRY). What can we learn from this Index? It represents a basket of 19 commodities ranging from agriculture (cotton, orange juice), grains (corn, soybeans and wheat), tropicals (cocoa, coffee, sugar), livestock (cattle, hogs), energy contracts (crude oil, heating oil, unleaded gasoline, natural gas), precious metals (gold, silver) to industrial metals (aluminum, copper, nickel) and is the main barometer of commodity price direction. Each commodity carries a different weight with Crude Oil being the single heaviest (accounts for 23% of the total). The most followed groups are energy, precious and industrial metals because of their influence on inflation and hence interest rates.

The reason why commodity prices are so important is because they are regarded as a leading indicator of inflation (or at least provides some useful information in forecasting it) and can tell a lot about which way the economy is heading. It reflects the future trend of the Consumer Price Index (CPI). Both the CPI and the Producer Price Index (PPI) are reported once a month whereas the CRB is a daily Index, giving a more constant assessment of the outlook for inflation. Rising demand for industrial and agricultural commodities means rising commodity prices and can reveal a heating economy as well as mounting inflationary pressures. If central banks tighten its monetary policy, interest rates rise, negatively impacting bond prices. The reverse is also true. It can be said that the bond market is sensitive to commodity trends as they may determine the future direction of interest rates.

As “hard times teach us the most valuable lessons” and if you are curious to learn how the bond and commodity markets behaved during the stock market crashes in 1987, 2002 and 2007/2008, take a look at this article.

The 2010s until today (the Russia-Saudi Arabia Oil price war and COVID-19)

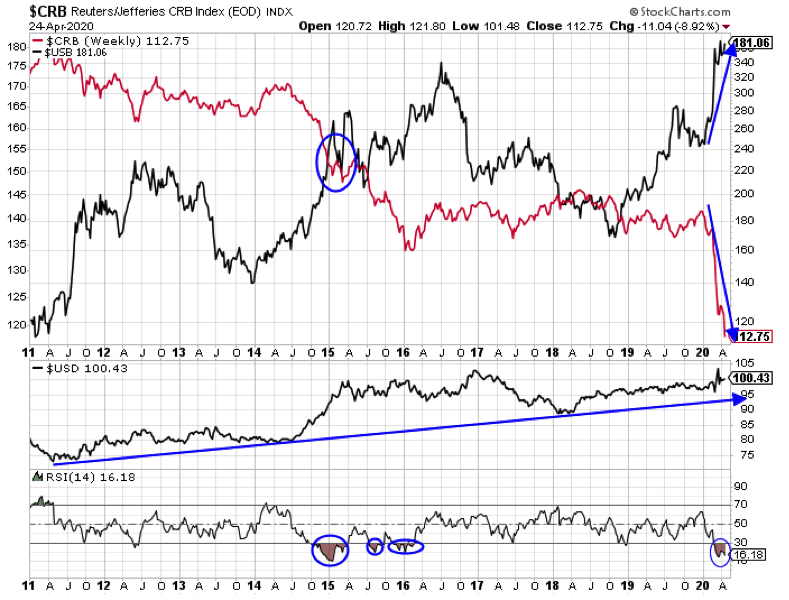

As expected, the chart below confirms the inverse relationship between bonds (USB) and commodities (CRB). Commodity prices fell and bond prices rose during the second decade of the 21st century. When inflation is under control and interest rates are subject to an overall downward path (despite some occasional increases), bonds rise as the appeal of safety and income lure investors to purchase them.

There is also a strong inverse correlation between the dollar (USD) and commodities. In other words, they have been trending in opposite directions from 2011 until today. The dollar hit the bottom and started rising during 2011, continuing to rally throughout this decade (see long-term uptrend arrow), having a negative impact on commodity prices. A change in the trend of the dollar index leads or coincides with a change in direction of commodities and vice-versa.

During times of crisis like the ones we are living in, money normally flows from risk-on assets such as stocks and commodities to risk-off assets such as the U.S. Dollar and Treasury Bonds. There have been major losses in stock markets, along with falling commodities prices and rising bonds prices. The current crisis results from two factors: the Russia-Saudi Arabia Oil price war and the COVID-19 global disease. The latter has been driving down demand for oil causing prices to fall. In response, in the beginning of March, the Organization of the Petroleum Exporting Countries (OPEC) agreed to impose a deeper round of production cuts in order to alleviate downward pressure on oil prices. OPEC presented the plan to Russia (since November 2016, Saudi Arabia and Russia created an informal alliance so as to manage the price of oil), who rejected to adhere, arguing that it would be important to first assess the real impact of the virus outbreak on oil demand before carrying out production cuts. After this announcement, oil prices plunged immediately and tumbled even further after Saudi Arabia and Russia said they would increase their production. However, OPEC members and allies have recently reached an agreement to slash production, from 1 May onwards, by approximately 10 million barrels of oil per day (or a 10% of global supply). Despite that, this deal has failed to address the supply-and-demand imbalance as global oil demand is estimated to have fallen much more than 10 million barrels of oil per day. Falling demand, rising inventories, as well as lack of storage capacity caused WTI crude prices to fall, temporarily, into negative territory for the first time.

The Federal Reserve (Fed), alongside other central banks, worried with the aftermath of the crash, eased monetary policy – expanding money supply and pushing short-term interest rates lower (and bond prices higher) – in an effort to stimulate borrowing and stem the drop in the stock market as well as providing a shelter for the economy from the effect of the virus.

Trading idea for the long-term future

– For Commodity traders: If the dollar falls sharply, it can push commodity prices higher. Look out for a bearish breakout of the long-term uptrend of the dollar index (see arrow in the chart above) as it can lead or coincide with a change in direction of the CRB Index. If so, make sure there is also a bullish breakout of the downtrend of this index.

– For Bond traders: In case the above-mentioned situation occurs, bond traders should not immediately assume that rising commodities will cause bond prices to fall. They should first identify which commodities did the rising. For example if copper prices, which are more closely correlated to the state of the economy and is deemed to be a good economic indicator, is in a downward trend and as copper is negatively correlated to bond prices, bondholders might decide to keep their positions despite rising CRB index. For further information on the importance of copper, read this article.

Remember that when two markets trend usually in opposite directions, and they give buy or sell signals at the same time, we should be aware that something might be wrong. A buy signal in one market is normally confirmed by a sell signal in the other.

The CRB Index/30-year Treasury Bond Ratio

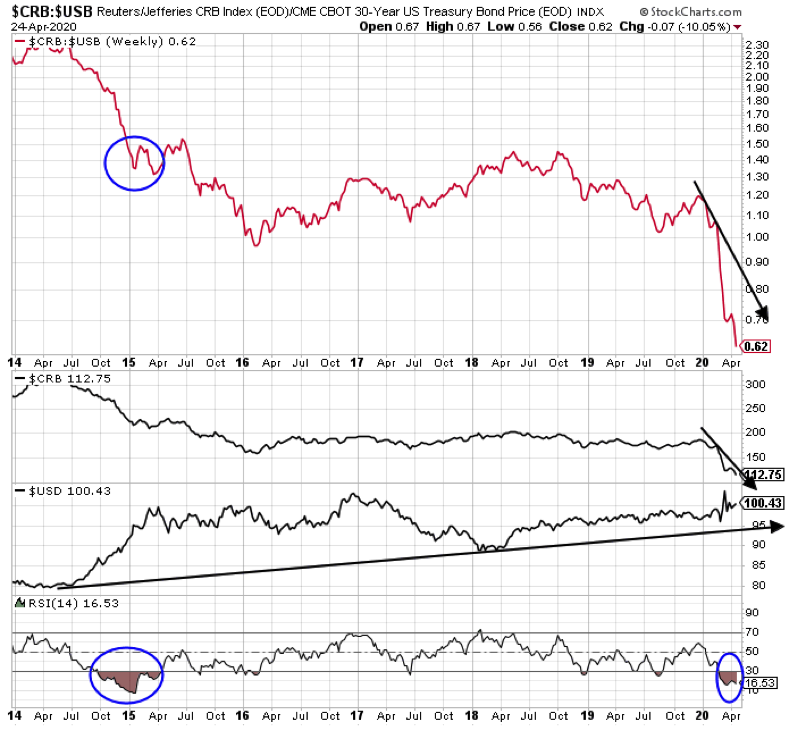

Ratio charts are useful indicators to determine which asset class is stronger at any point in time and to spot trends changes. Traditional technical analysis indicators such as moving averages, support, resistance levels and so forth can also be applied to these charts.

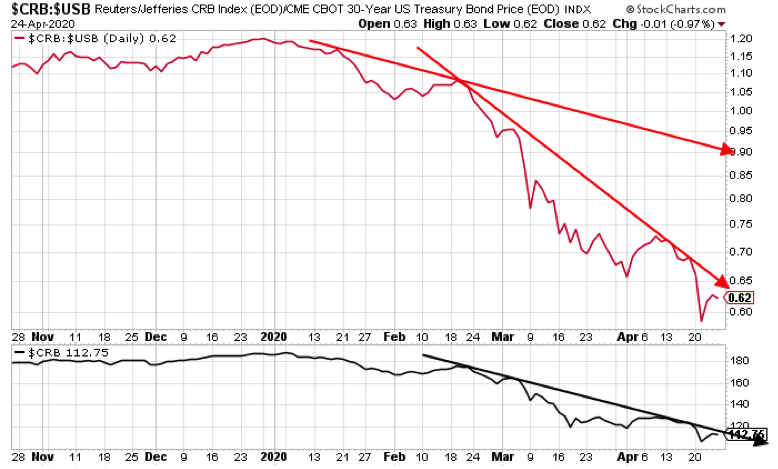

This article compares the bond and commodity market in the last decades and describes how their relationship evolved over the course of the last decades. The following chart plots the CRB Index/30-year Treasury Bond ratio over the last months. I have drawn some trend lines in the chart in order to make it easier to identify turns. A falling ratio indicates that bonds are the better market to be whereas a rising ratio indicates the opposite. In case you want to deepen your knowledge and find out how this ratio behaved historically, click here.

– Trading idea for the short-term: Look for a bullish breakout of the most steep short-term trend line of the ratio. If it happens, the move will need to be confirmed by a breakout of the short-term downtrend of the CRB Index. The behavior of the Dollar index will also need to be factored in.

– Trading idea for the long-term: The ratio continues to follow a downward path – however, a bullish correction may occur as the RSI is floating in the oversold territory. The long-term bearish outlook will only change in case there is a breakout of the long-term uptrend of the dollar index as it may it can push commodity prices higher. If so, make sure there is also a bullish breakout of the downtrend of the CRB index.

Conclusion

Movements in the dollar often play an important role in commodity prices. If commodity markets influence bonds, which then influence stocks, commodities are indirectly linked to stocks. Therefore, if you want to succeed, you should analyze the bond market as well as the commodity sector. You should always monitor the relative trend relationship between commodities and bonds, as this can determine inflationary expectations, the interest rate’s likely direction, and the outlook for these markets (alongside others). However, when assessing the relationship between bonds and commodities, it is also advisable to know what is happening in the remaining markets. We will help you through this journey!

If you would like to keep up on the latest UPDATES, come by and connect with us on TWITTER.

Disclosure: Please remember to consider every piece of investment information you receive here as an idea for further consideration. It does not constitute a recommendation to buy or sell assets and does not take account of your adjectives, or your financial situation. At the time of writing this article, I do not have any position in the assets mentioned. Thank you for reading.